Ohio legalizes recreational marijuana in a recently passed ballot initiative. Ohio’s Issue 2 legalizes recreational marijuana use, possession, and home cultivation for adults aged 21 and older. Here are the key highlights of this new law:

- Age and Possession Limits: Adults 21 and older are permitted to possess up to 2.5 ounces of marijuana and up to 15 grams of cannabis concentrate.

- Cultivation and Home Growth: Individuals are allowed to cultivate up to six marijuana plants at their primary residence. For households with more than one adult, up to 12 plants can be collectively cultivated. These plants must be grown in a secure, enclosed area and not visible from public spaces.

- Sale and Purchase Regulations: The initiative legalizes the sale and purchase of marijuana in various forms, including plant material, seeds, extracts, edibles, vaporization devices, and more. The Division of Cannabis Control, created under the initiative, is responsible for regulating and licensing marijuana operators and facilities.

- Restrictions and Employer Rights: Smoking, vaporizing, or any form of combustible marijuana usage is prohibited in vehicles, bicycles, boats, and aircraft. Employers are not required to accommodate marijuana use and retain the authority to make employment decisions based on an individual’s marijuana use, possession, or distribution.

- Division of Cannabis Control: This division within the Department of Commerce is tasked with licensing, regulating, investigating, and penalizing cannabis operators and testing laboratories. It sets standards for THC content, application and licensure, and marijuana delivery, among other responsibilities.

- Social Equity and Jobs Program: This program aims to assist those most impacted by previous marijuana-related laws. It provides financial assistance, loans, grants, and technical assistance to certified participants and promotes hiring practices focusing on minorities, women, veterans, and persons with disabilities.

- Taxation and Revenue Allocation: The law sets a 10% sales tax on marijuana purchases. Tax revenue is allocated to various funds, including the cannabis social equity and jobs fund, the host community cannabis fund, the substance abuse and addiction fund, and the division of cannabis control and tax commissioner fund.

- Local Control: Municipalities can adopt ordinances to limit the number of cannabis operators but cannot restrict home growing of marijuana or levy additional taxes or fees on marijuana businesses. A dispensary can request a public vote if a new ordinance threatens its operation.

As Ohio Legalizes Recreational Marijuana, Other States May Follow Suit

Ohio’s Issue 2, the marijuana legalization initiative, garnered significant support statewide, with 56.8% of voters approving the measure. This decisive outcome reflects a shifting attitude towards cannabis legalization in the United States, particularly in more conservative-leaning states. Matthew Schweich, the executive director of the Marijuana Policy Project, highlighted the importance of this victory, noting it as a culmination of efforts that began with Ohio’s medical cannabis law in 2015.

Paul Armentano, deputy director of the National Organization for the Reform of Marijuana Laws (NORML), emphasized the bipartisan nature of cannabis legalization, pointing out that Ohioans have observed the successful adoption of similar laws in neighboring states and prefer regulating the cannabis market over maintaining prohibition.

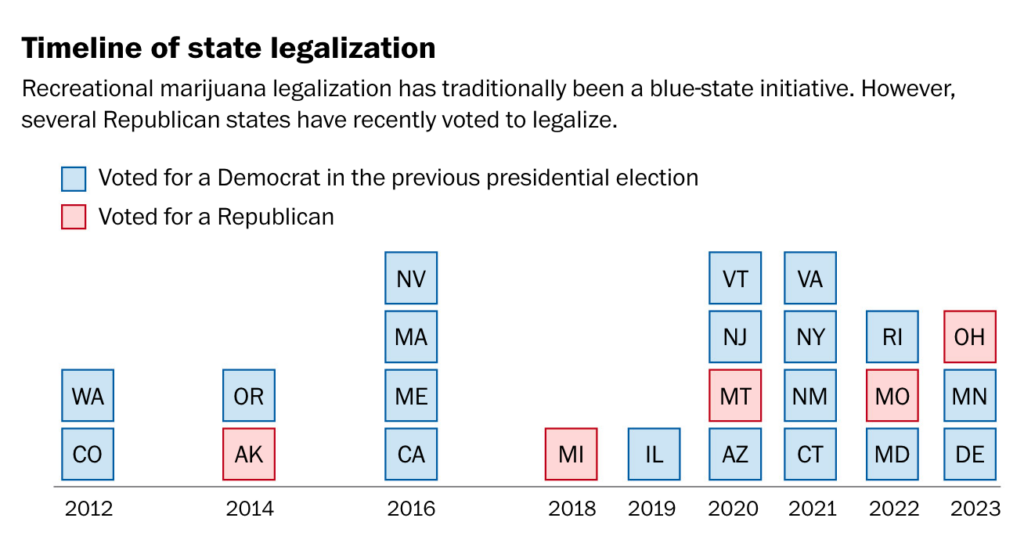

The passage of Issue 2 in Ohio, which makes it the 24th state to legalize adult-use marijuana, signifies a broader trend in the U.S. towards legalization, especially in states with more conservative political leanings. With Ohio’s inclusion, over half of the American population now lives in jurisdictions where marijuana is legal for adult use.

The implications of Ohio’s decision extend beyond its borders. The establishment of a legal marijuana market in Ohio is likely to exert pressure on neighboring states like Pennsylvania, West Virginia, Kentucky, and Indiana. These states may experience an outflow of residents crossing into Ohio to purchase marijuana, thereby contributing tax revenue to Ohio instead of their home states. This dynamic could incentivize these neighboring states to consider legalizing marijuana to retain tax dollars and manage cross-border traffic.

In summary, the support for Ohio’s marijuana legalization initiative not only reflects a growing acceptance of cannabis in conservative states but also indicates a potential ripple effect across the U.S., particularly in states neighboring Ohio. The success of Issue 2 may serve as a catalyst for further legalization efforts in other states, especially as they observe the economic and social impacts of Ohio’s newly established marijuana market.